🔍Company Deep Dive #2 - $WM (Waste Management Inc)

Is it worth paying a premium for the trash management business?

Waste Management is one of those companies which I think will benefit a lot from the reopening economy once the pandemic is over, this is because as more and more corporates and businesses resuming their operations, one thing that is bound to go back up will be the amount of rubbish we will all be producing again. As reliable as the business may seem, paying too much for a good company can end up turning it into a bad investment. Let’s dive deep into the company’s valuation and discuss its future outlook.

◆What is Waste Management Inc?

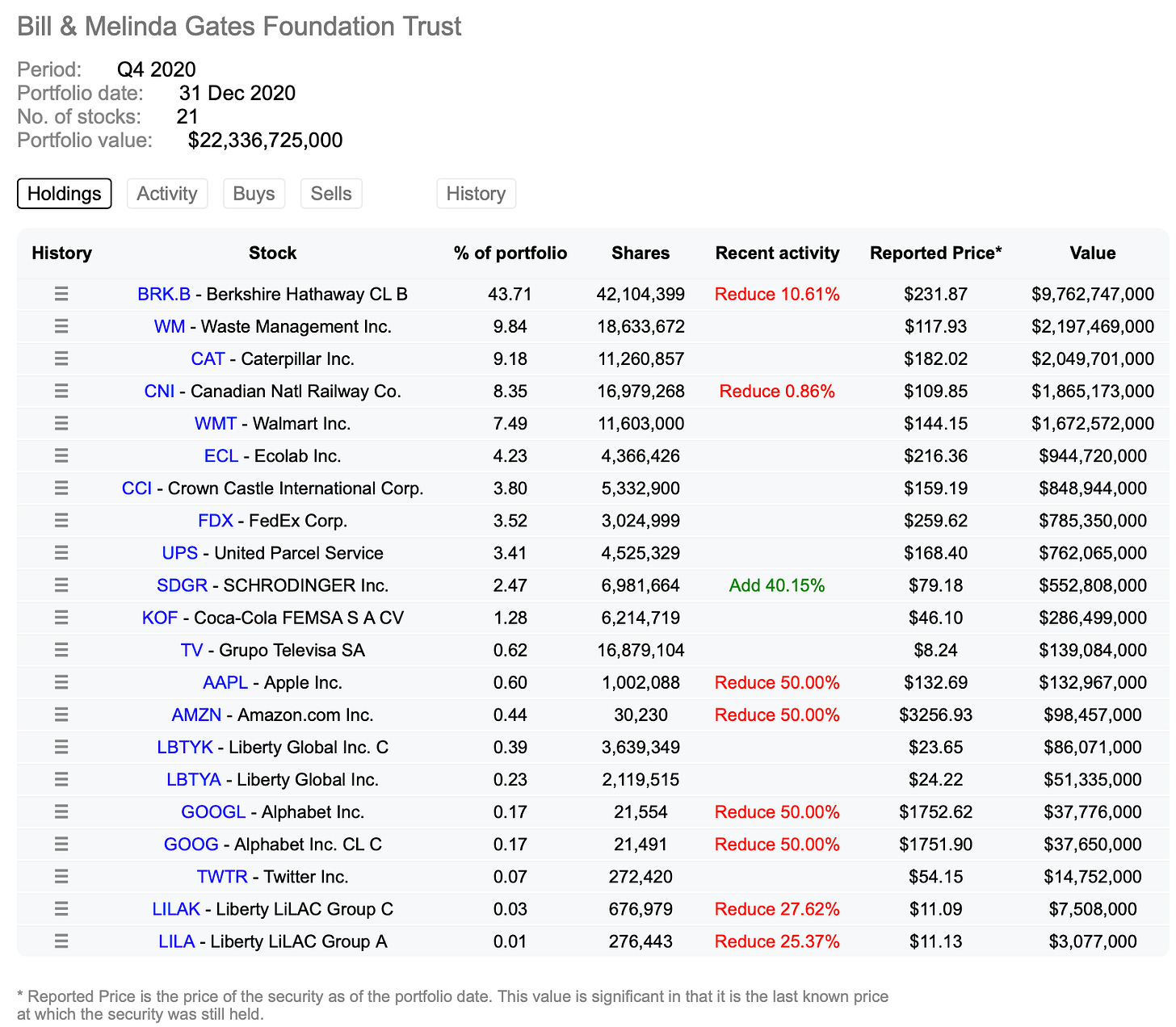

Waste Management Inc, as the name suggests, is an American waste management company located in North America. Waste Management Inc generates its revenue through the provision of various waste management and disposal services and recycling solutions to residential, commercial, industrial, and municipal clients. With its broad portfolio of specialist services and network of infrastructure, Waste Management Inc is likely to remain as one of the biggest leading company in the industry for foreseeable future. Fun fact: $WM is the second largest holding in Bill and Melinda Gates Trust after Berkshire Hathaway.

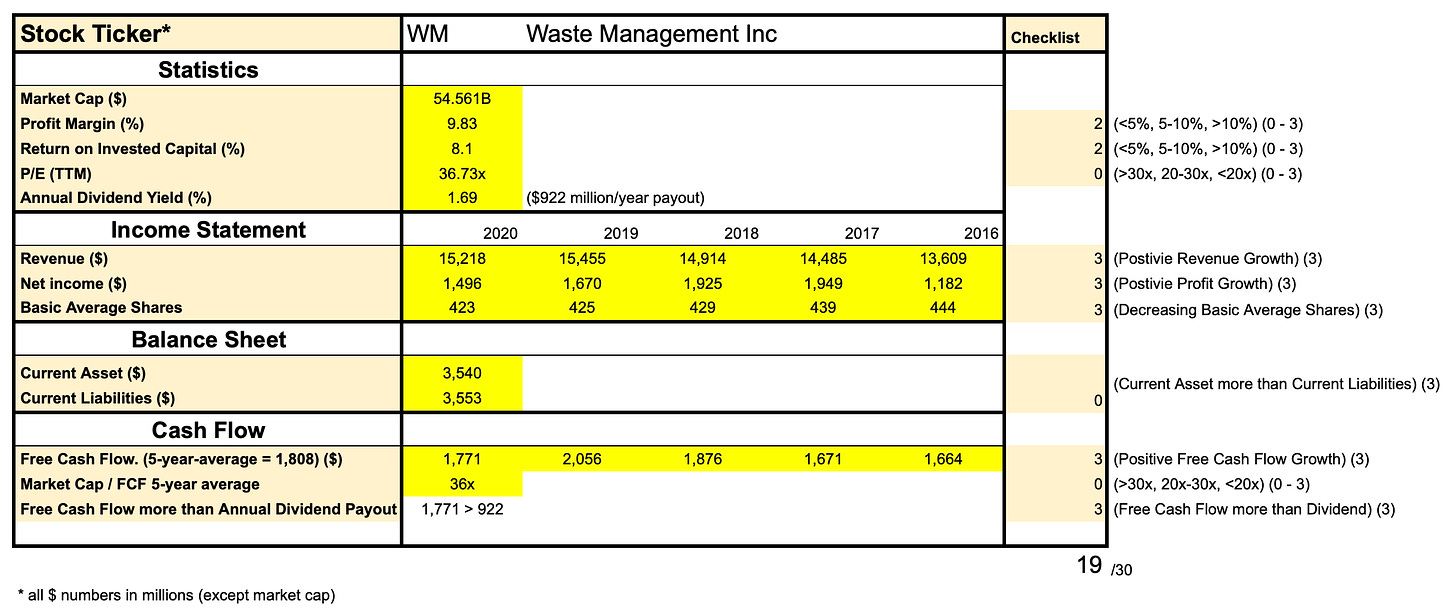

✅ First Glance at Financial Checklist

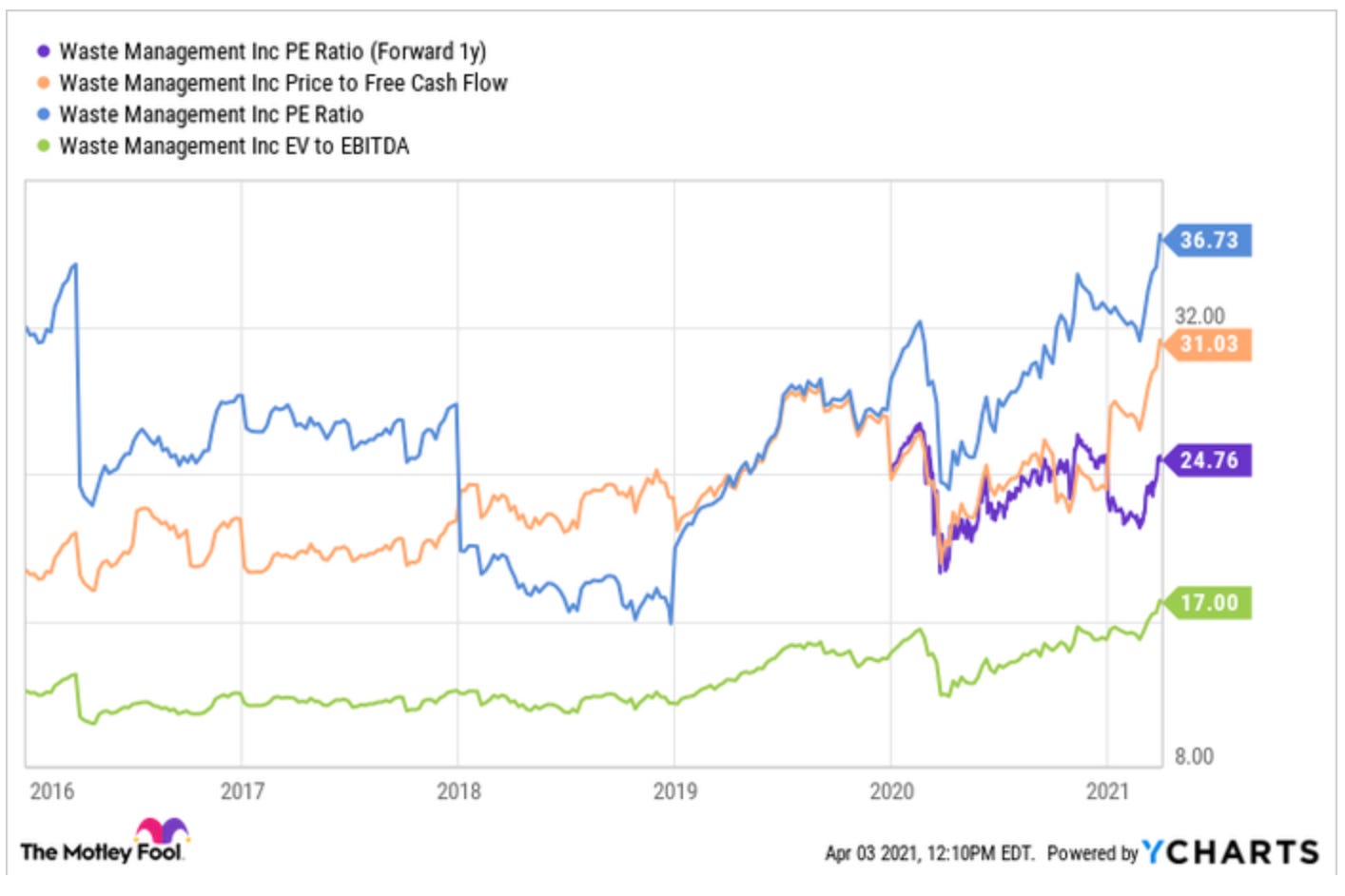

Our 10 Pillars Financial Analysis had generated a score of 19/30 for Waste Management. This score shows that Waste Management actually has a healthy financial statement on first glance. On top of increasing revenue and net income throughout the past 5 years, the company had obviously been buying back stocks as well, which is always good for existing shareholders. However, it is without a doubt trading at a valuation very much similar to a fast-growing tech company with a 36x price-earning multiple, which we will be focus a lot more in the following discussion: is it worth paying a premium for this reliable trash business?

◆ What's good?

Huge economic “moat” - The company has some irreplaceable assets which includes its massive fleet of trucks and broad network of waste management infrastructures and facilities, including 244 solid waste landfills and five hazardous waste landfills, all of which are highly regulated assets which is one of the criteria value investors look for while searching for a value play to add to the portfolio.

Commitment to shareholders - As mentioned above, Waste Management has been buying back its shares consistently in the past 5 years, which means each shareholder gets a bigger slice of the pie, and pie in this case is public ownership of the company. Just in case you are wondering, this is indeed a good thing for us as investors. On top of that, the company had increased its dividend annually for 17 consecutive years. It increased its annualised dividend from $2.05 per share to $2.18 per share in 2020.

Less exposed to the economy - Compared to other industries, the company is relatively more immune to the economy considering the fact that waste management is pretty much a necessity regardless of what's going on in the world or on Wall Street. Although the company reported that 2020 adjusted revenue was down less than 2% compared to 2019 and adjusted net income was down around 9%, there was a significant increase of 26% in free cash flow which can be used for share buyback and raising dividend in 2021. It is definitely one of the safest investments today.

◆ What's bad?

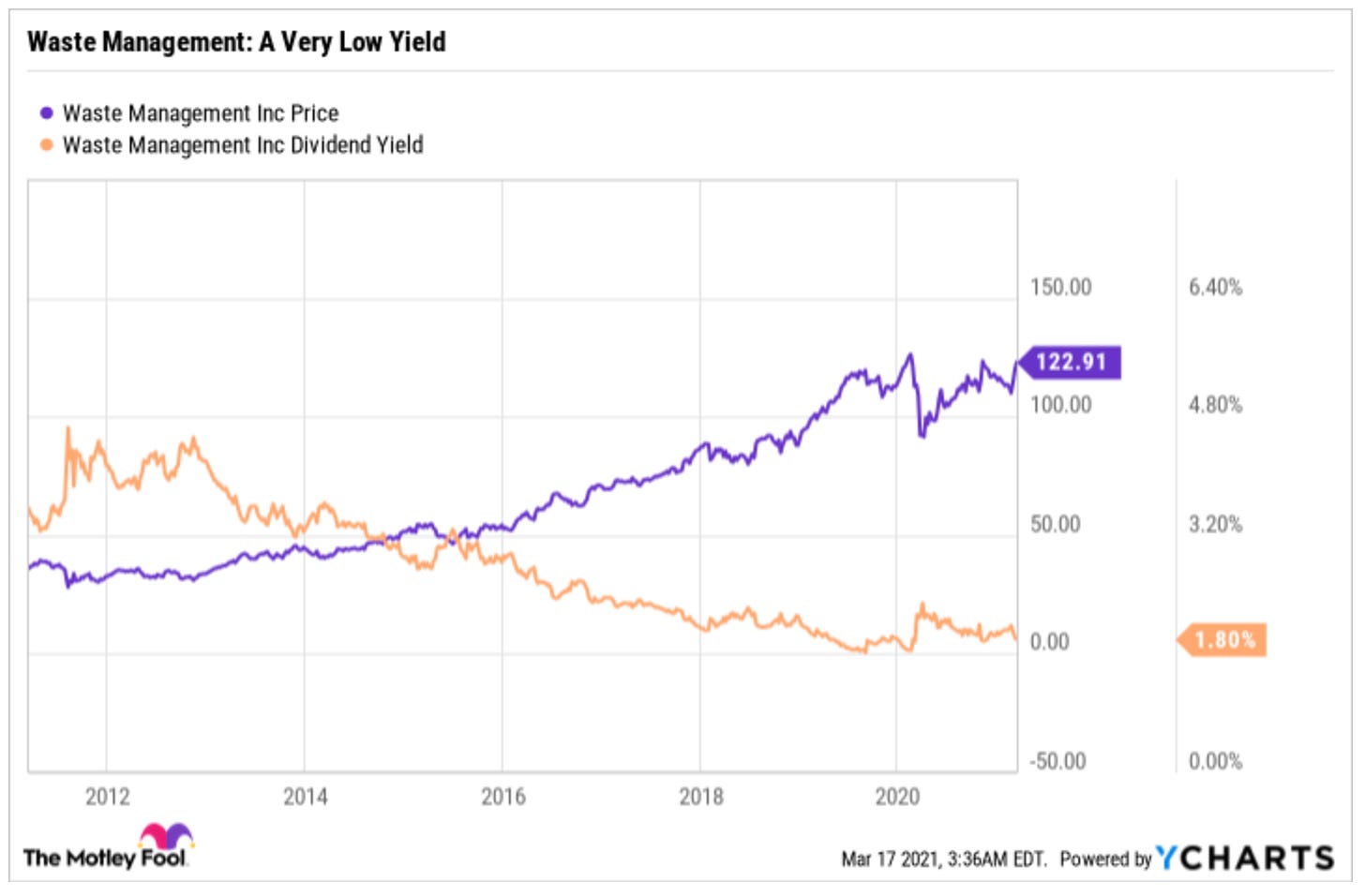

Low dividend yield - Currently the company has a dividend yield of 1.76%, which is slightly under the long term average dividend for S&P500: 1.87%. Therefore, income investors would most likely steer away from this stock and look for better alternatives out there. The fact that current dividend yield is near the lowest level in the past decade might also suggests that the stock is richly valued at the moment.

Valuations are at multi-year highs - Just to give you a better idea of what sort of valuation Waste Management has today with its current stock price, Facebook and Google, both fast-growing tech companies are currently trading at a p/e multiple of 30.62x and 37.97x respectively, whereas Waste Management Inc, with much slower growth rate is currently trading at 36x p/e multiple. Some might not consider this to be a feasible comparison considering they are operating in different industries which often have different valuation assumptions and measures, however, I think the stock might have very well been overbought at this stage.

🎞 Recommended video (4 mins)

🐦 Tweets to read:

◆ What are my thoughts?

Early this year, I was searching for a defensive stock to invest in while the market was comparatively more volatile then, I bought $WM at $113.99 with the expectation that there is a potential 10% upside to the stock price, considering that the business will benefit from the reopening economy. Even then the stock price was considered overvalued by most value metrics (as covered by the YouTube video above). Since then, the stock had surged significantly. Last week, I had sold my positions for 13.70% gain mainly because I no longer think that the stock’s valuation is justifiable by its current growth rate. If I am selling stocks at some stage, I would very much prefer to sell them now at a premium instead of when the stock price finally fall during correction. If the stock price does retreat by 10% from today’s price point to around $115-116, I would then consider to reinvest into the company. Stay tuned for another analysis when that happens.

If you enjoy this post or Stock Investing on FIRE as a whole, please give it a ❤️ and recommend it to your friends to spread financial wellness to more people.

Best, HaoNing